Concerns over coronavirus have prompted a number of measures in the world’s co-op and credit union sectors.

In the USA, CO-OP Financial Services has postponed its Think 20 Event, a conference on credit union collaboration and innovation for three months.

Due to be held at the Omni Hotel, Dallas, from 4-7 May, the conference will now take place on 17-20 August, at the same venue.

“We have been carefully monitoring the public health concerns surrounding the coronavirus outbreak,” said Todd Clark, president/CEO of CO-OP. “After careful consultation with a number of our clients, board members and stakeholders, and in an abundance of caution, we have made the decision to postpone.”

CO-OP says it will also hold a one-day virtual conference event in May, with the exact date and content details to be confirmed in the next few weeks.

Attendees currently registered for Think 20 will be automatically registered for the digital event in May and new live event dates in August. Those who cannot attend the new dates have until 1 August to cancel and receive a full refund.

“Our Think conference regularly attracts more than 800 attendees and, again, it is for their health and safety that is paramount to our decision,” said Clark. “We thank everyone in the credit union movement for their understanding and we look forward to seeing you later in the summer.”

Travel concerns saw the World Council of Credit Unions (Woccu) cancel its Young Professional Exchange and Global Youth Summit, scheduled for the UK on 9-15 March. The Association of British Credit Unions (Abcul), which helped to organise the event, is proceeding with a modified programme for credit union professionals who have elected to still participate.

Meanwhile in Canada, outdoor equipment supplier Mountain Equipment Co-op has put a key a feature on hold at its new flagship store in Vancouver’s Olympic Village.

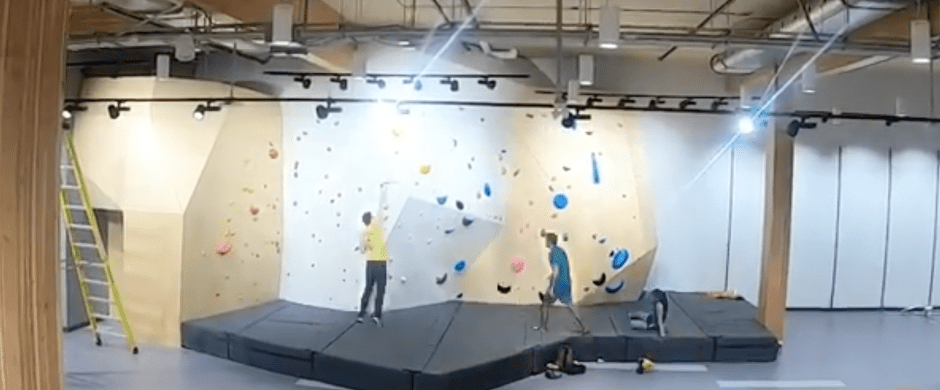

The state of the art, 33,000 sq ft, two-level store includes a climbing wall but this has been closed to the public.

“We’re just being extra safe here,” said spokesperson Andrew Sutherland said. “It’s a precautionary step. We’re thinking about the health of members and our staff.”

The co-op has also temporarily suspended its equipment rental programme, normally on offer in all but one of its stores.

“We’re taking precautionary steps due to COVID-19, so we’re pausing our rental program for the moment,” said MEC on social media. “We take your health seriously and are looking into the best way to safely maintain our rental gear going forward.”

Another outdoor equipment co-op, the USA’s REI, says it is “increasing the frequency and rigour of cleaning and sanitisation in all of our retail stores, distribution centres and office environments”.

It added: “Based on the guidance we’ve received and the actions we’ve taken, our stores remain open for business.

“We are updating terms for cancellations and refunds for all REI events, activities and adventure travel programmes to provide members and customers greater flexibility in making decisions that are best for them, without incurring financial penalties.

“We have modified our paid time off policies to ensure that our employees – including hourly retail employees – who miss work due to illness or to care for sick family members do not suffer loss of income or other benefits.”

The US credit union sector has been warned that the outbreak could wreak havoc havoc on the industry.

Credit Union Journal says falling consumer confidence and an economic slowdown resulting from the disease will hit lending business. There are also practical operational problems to face – for instance, Seattle Credit Union, in a city hard hit by the coronavirus, has temporarily closed its headquarters because another tenant in the building was exposed to the virus.

Alongside wider concerns over the impact of a potential recession sparked by a pandemic, there is the issue of what happens when borrowers fall ill or are forced to self-isolate, hampering their ability to meet repayments. The regulator for the sector, the National Credit Union Administration (NCUA) has encouraged institutions to “meet the financial needs of customers and members affected by the coronavirus” and to “work constructively with borrowers”. The release added that “prudent efforts that are consistent with safe and sound lending practices should not be subject to examiner criticism”.

Credit Union Journal says its possible that NCUA and other regulators “will ask credit unions about their business continuity plans with a specific focus on handling a pandemic, and institutions should be prepared for that”.

In the United Arab Emirates, retailer Union Coop is having its shopping carts and trolleys sanitised regularly to make shopping safer.

Dr Suhail Al Bastaki, director of the happiness and marketing at the co-op, said: “Additionally, we have dedicated staff in branches to ensure the cleanliness of trolleys and carts before and after consumer use.

“Furthermore, we have installed sanitisation pods in different areas of Union Coop branches for consumers and shoppers to sanitise their hands continuously free of cost.

“All our front-end staff follow appropriate standards of hygiene and sterilisation. We will be organising workshops for the employees in co-operation with the competent authorities on how to prevent coronavirus and its spread.”

Co-op News has been in contact with the UK retail sector about measures it is taking, which include the rationing of hand sanitiser gel to prevent panic buying. Full story to follow.

Paragraph 8 of this story was amended on 11 March to clarify the circumstances around the Young Professional Exchange and Global Youth Summit.