Over 1,100 people from 30 countries attended day one of the first all-virtual World Credit Union Conference on 14 July.

World Council Of Credit Unions (Woccu) chair Rafał Matusiak welcomed attendees, telling them 2021 had been a challenging year but credit unions had shown they could be relied on, continuing to serve members through the pandemic while prioritising their safety and that of employees.

“I hope the next week is full of new ideas, networking and sharing the spirit of credit unions,” he said. “Together we are stronger, more agile and more effective.”

He provided an overview of Woccu’s work over the past 12 months, with the apex implementing development projects in 11 countries. Some of these focused on digitisation, incentivising the creating of affordable housing options and promoting legal and regulatory reforms.

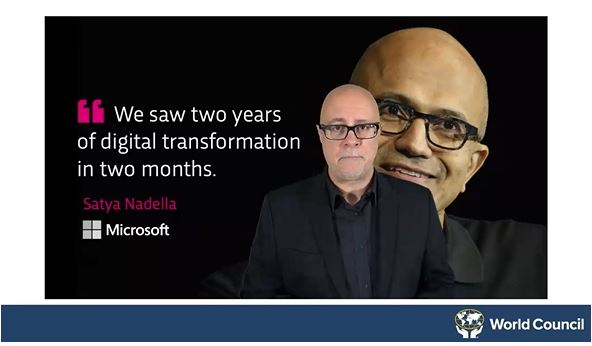

Day one of the conference was focused on digitisation, featuring a keynote address from Greg Verdino, a business futurist and digital transformation expert. Mr Verdino talked about the need for credit unions to adapt in face of wave after wave of change – what he calls “the never normal”.

He encouraged credit union leaders to “embrace ambiguity”, “commit to acting in the face of imperfect information” and “commit to experiment in the face of uncertain outcomes.”

He added: “Now is the perfect time the exact right time to take part in reimagining the future of credit unions, the future of banking, or even the future of financial services in general.

“How can you accelerate your own evolution, how can you turn urgent action on your part into a strategic advantage? For many traditional businesses this naturally requires a willingness and an ability to challenge the status quo to rethink assumptions to step into the unknown. Naturally, the more comfortable you become with the ways in which your world is changing, the less uncertain those steps will feel.”

He added there was an appetite among some of the big tech companies to work with credit unions – and encouraged the sector to consider collaborations, both within and outside the credit union world. But he warned that credit union leaders should not try to change too much too quickly, but prove success incrementally and scale as fast as they can.

Explaining that online-only financial service organisations are here to stay, he asked credit unions to think about ways to create value for a new generation of customers.

His other tips for the sector included growing the digital literacy of people involved in their organisations and being prepared to let go of things that no longer work for their customers or their businesses.

WCUC’s 2021 focus on digital transformation falls in line with WOCCU’s own Challenge 2025 initiative, which set the target to digitise of the global credit union system by 2025.

Click here to read more reports from the World Credit Union Conference