Since the 2008 financial crisis, we have become used to discussions of bank “capital”.

Capital is described as a loss-absorbing cushion that enables banks to lend at risk without putting depositors’ money at risk. Regulators have been tightening “capital requirements” in an attempt to force banks to increase their “capital buffers”.

All of this jargon around “capital” makes it sound as if it is something peculiar to banks – in particular to the sort of commercial bank that so disastrously failed in 2008.

So when we find a section in the latest World Co-operative Monitor discussing “capital structure” for co-operatives – and particularly for agricultural and food co-operatives – we could perhaps be forgiven for thinking the author has lost the plot. What on earth does capital structure have to do with agriculture and food? And do co-operatives even have “capital structures” anyway?

The author, Professor Flavio Bazzana of the University of Trento, doesn’t exactly explain what “capital structure” is, let alone why members of the co-operative movement should be concerned about it.

So, before I delve into Prof Bazzana’s findings, here is “Co-operative Capital Structure for Dummies”.

Co-operative capital structure – an outline

All companies, regardless of their ownership model, have a capital structure.

The simplest is one made up entirely of owners’ equity. The owners own the business, they contribute their own funds to it and they share any surpluses not required for reinvestment among themselves. When the company is wound up, they each take a share of the assets. This is the capital structure of many small businesses, including co-operatives.

Many would regard a capital structure made up entirely of owners’ equity as the optimum for a co-operative. The members are the owners: they contribute funds, they collectively decide on the management of the business to mutual benefit and the reinvestment or distribution of surpluses – and, if the co-operative is wound up, they each take an equal share of the assets.

The trouble with this model is that it can be hard for the co-op to grow. Growth requires investment: if the money for investment comes solely from members’ contributions and retained surpluses, growth can be slow and opportunities can be missed.

Related: CUEB gathering on ethical future of Co-op Bank

A commercial company can raise money by selling shares in itself to outside investors – though business owners can be reluctant to do this, since it dilutes their holding and can mean they lose effective control of “their” business. For co-operatives, however, selling shares to outside investors can be hugely problematic. The democratic “one member, one vote” structure can discourage benign investors and encourage carpetbaggers: once outside investors have a controlling interest (over 50% of the shares), it is no longer a co-operative. In many countries, external investment in co-operatives is limited by statute.

Many co-operatives therefore prefer to finance investment by borrowing. Their capital structures are a mixture of equity and debt.

Related: How to improve monitoring and control within boards of financial co-operatives?

The holders of debt – bonds or bank loans – have a prior claim over the assets of the company. In the event of insolvency, all debts have to be settled before the owners of the company can claim their share of assets. If there are insufficient assets to settle all debts, the owners of the company get nothing, and the creditors receive a share of the assets depending on the ranking of their claim. “Senior” debt, such as bonds and bank loans, is settled before “subordinated” debt, such as preference shares. The higher risk of loss that holders of subordinated debt incur is reflected in a higher interest rate.

In most countries, there are tax advantages from financing with debt, since interest payments are tax-deductible (this is known as the “tax shield”). This tends to encourage companies, including co-ops, to finance with debt rather than equity.

The proportion of equity to total assets in a capital structure is known as the “leverage ratio”. Another version of it is the debt-to-equity ratio. In either measure, the higher the proportion of equity, the safer the company is perceived to be for creditors and the less they will charge in interest.

Co-operatives and debt

So what do Prof Bazzani’s findings tell us about the capital structure of large co-ops?

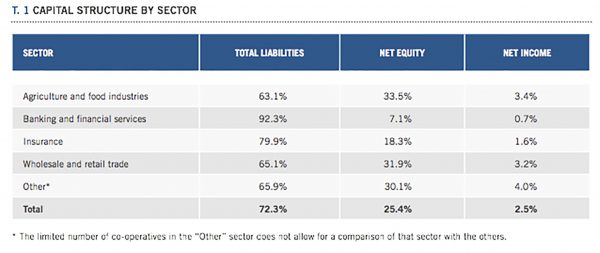

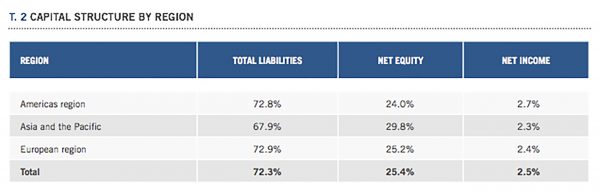

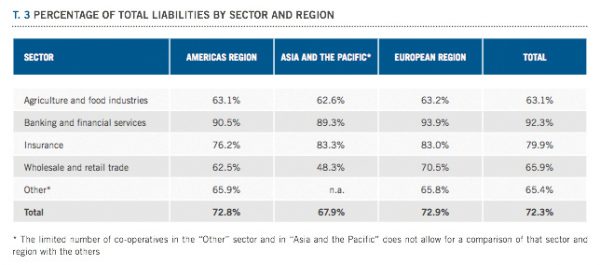

Compared to commercial corporations, large co-ops tend to have more equity and less debt. Prof Bazzani particularly found that co-ops in the agriculture and food industries, and wholesale and retail trade, tended to have low leverage.

“This aspect makes the co-operatives more solid in a financial sense and less dependent on external financing,” he says.

It is hard not to conclude that the co-operative structure itself helps to ensure that they are more resilient than commercial companies who are dependent on the whims of external investors.

But co-operative banks have much higher leverage ratios than other co-ops. This is typical of banks in general: co-operative banks in this respect are no worse than commercial ones. The shortage of equity is particularly acute in European co-operative banks.

Related: What is the role of co-ops in building a frugal society?

Prof Bazzani accepts this – and its consequences, lower net income and poorer return on equity – as a necessary feature of the banking industry, and commends co-operative banks for their conservative approach to lending that makes them less risky. But I am unconvinced.

Thin equity slices have two effects: they raise the risk of losses for bondholders and large depositors (recent legislation by the EU reduces the likelihood of taxpayer support), and they discourage banks from taking risk.

But lending to risky enterprises is essential for economic growth – and in Europe, only banks really perform this function. Discouraging banks from taking risk, therefore, is a recipe for economic stagnation.

In their book “The Bankers’ New Clothes”, Anat Admati and Martin Hellwig argue that banks should have much larger equity slices. This would enable them to lend to risky enterprises such as small businesses without putting depositors at risk.

I wonder whether co-operative banks could take a lead on this, progressively reducing their leverage to the level of non-banks so that their risky lending is supported far more by equity than debt.

Prof Bazzani wishes co-operative banks would invest more in technological innovation: I agree with this, but I think respecting co-operative values requires a more cautious, longer-term approach to investment. “Grow your own” does not mean borrow money from the bank and run down to the garden centre to splash out on the latest designer plants.

The co-operative model, vindicated

Prof Bazzani finds little evidence for the widespread belief that co-ops struggle to raise capital for investment. Large co-ops are generally well capitalised, financially sound and conservatively governed. This comes as a huge relief – and a great vindication of the co-operative model.

In the past, the belief that co-operatives can’t raise capital has led to swathes of demutualisations. We now know that demutualisation simply makes the new company a target for takeover: not one of the building societies floated in the 1980s and 1990s now survives as an independent organisation. In contrast, the UK’s fifth-largest lender, Nationwide, remains a mutual – and has never required a government bailout.

In view of this, do we really need regulatory initiatives to create new forms of financial instrument to help co-operatives raise capital without being seen to do so? These instruments are fraught with problems. They are risky by definition, since they combine features of both debt and equity and it is not always clear how they would be treated in the event of losses. And they are too often sold to the wrong people.

Related: Former Co-op Bank chief executive admits misconduct

We have recently seen, in Italy and here in the UK, what happens when ordinary people are persuaded to buy subordinated debt (e.g. preference shares, PIBS, PPDS) as higher-interest forms of retirement savings. In Italy, when four failing banks were put into resolution, many elderly people lost their savings – and one man committed suicide.

In the UK, the fact that many of the Co-op Bank’s PIBS and preference shares were owned by ordinary people caused a storm which led eventually to the Co-op Group losing control of the Bank to a helpful consortium of hedge funds that made these small investors a better offer.

Should co-operatives be using such instruments at all? Surely co-operative values mean being honest, transparent and fair to their members – in capital structure decisions as with everything else?

It seems clear to me that co-operatives can and should eschew raising capital by means of hybrid financial instruments that are open to misunderstanding and abuse. Let’s keep things simple. Equity means equity, and debt means debt. And for a co-operative, there should be a lot of members’ equity, and not so much debt. Even if it is a bank.