With the housing crisis continuing to inflict hardship on people across the country, a new co-op in Sheffield is offering long-term affordable homes for 48 people.

Based in the historic Marples building in Sheffield city centre, the co-op was set up by Roost, which describes itself as a tech-for-good startup. A secondary housing co-operative, Roost is using an online platform to enable groups of people to set a budget and choose a preferred location. The co-op then deals with all the legal aspects and paperwork.

It’s a timely response to a problem that is brining generational inequality: the Resolution Foundation’s 2023 intergenerational audit found that young people are still far less likely than previous generations to own their own home and more likely to be stuck in the private rented sector.

The private rental experience is often an unhappy one – and this was the main factor which spurred the founding members of Roost to take matters into their own hands by setting up housing co-ops.

“Housing is not very good for young people right now,” says Roost co-founder Ben Dunn Flores, 24. With rents increases outpacing wages it is becoming increasingly difficult for young people to pay their rent or save for a deposit. This has long been the case in London, notorious for its soaring prices – but the problem is spreading to other cities too.

“We’re starting to get housing crises in the other cities in the UK,” says Dunn Flores. “And it’s starting to get to the point where the income we get from living in a city isn’t enough to enable us to pay rent to live in that city or save for a deposit. And we want to solve that – because we think co-ops can do that by separating a home as a financial product from a home as a place to live, that you can stay in as long as you want.”

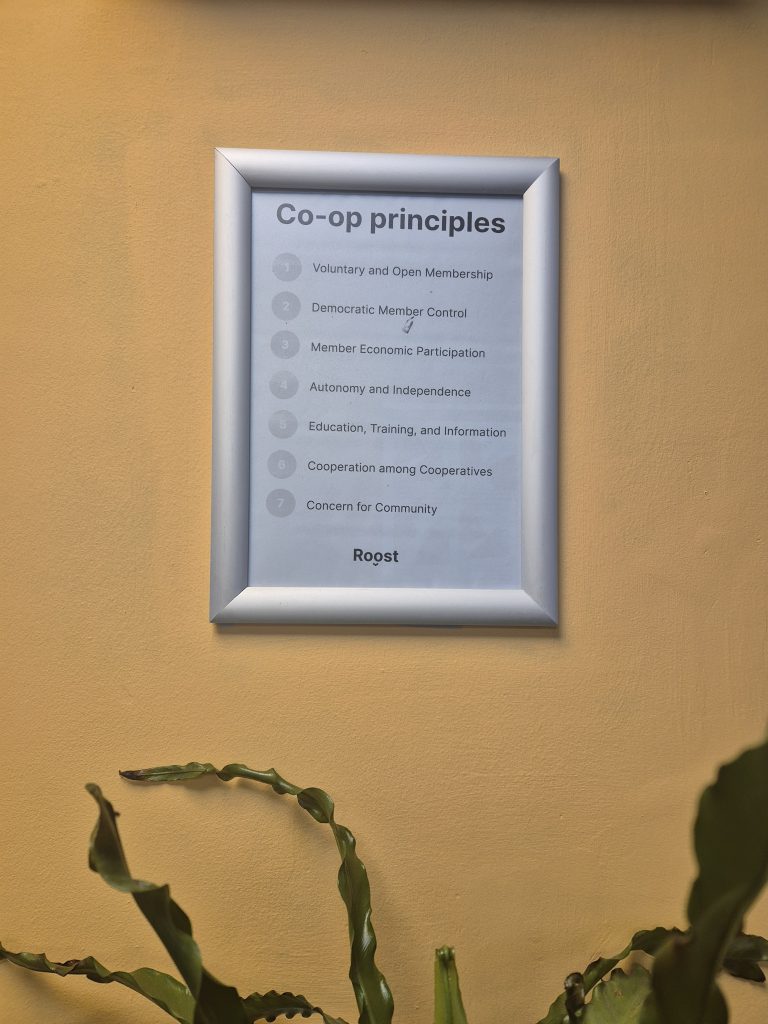

From Roost’s perspective, co-ops can play a key role in fixing the housing crisis. But, warns Dunn Flores, “principles are only as good as other things that you’re willing to sacrifice in their service.”

Roost had initially planned to buy a property, put it in an asset lock and turn it into a co-operative, he says. “We then realised that we just didn’t have the track record to be able to do that, so we needed to work with landlords to build up to that point and prove that co-operatives can manage homes better than landlords can.

Related: A co-operative answer to the UK’s housing crisis?

“We needed to prove that landlords are surprisingly inefficient – especially the small amateur ones – and that there can be a better home for tenants and better returns for investors.

“I know this isn’t something that’s usually part of the co-operative ethos in housing – where all of the housing is controlled by us – but we have to work with them.”

Roost hopes that by running tenant-led housing co-ops, it can build a portfolio and acquire the bargaining power to get funding to acquire its own properties. And the ultimate goal for all of Roost’s activities is to create more co-ops, adds Dunn Flores.

One of the biggest challenges faced by new housing co-ops is getting finance.

“The current ways that housing co-operatives are financed are very difficult to work with,” he says. “One of the things that keeps happening is that the financers of co-operatives move so slowly that when people identify a house, put together a business plan and send it to the bank, the bank takes three weeks to review it.

“And by the time they come back, the house has been sold, so they have to start the process all over again.”

The existing housing co-op movement has a lot of assets which could be potentially leveraged – but the way those co-ops were set up makes this difficult (see Co-op News interview with Blase Lambert). Dunn Flores also believes that older housing co-ops “want to make sure that their money is really, really safe”.

“It turns out that when 20-year-old anarchists become 70-year-olds, their priorities change,” he says. “Most of the UK’s housing co-ops were set up 50 years ago.”

To address the issue, Roost is exploring financing options – ones which are new to the co-op sector, says Dunn Flores.

“We are doing that because we believe that the more co-operatives, the better. And while there are opportunities within the sector to get money, they’re difficult to take advantage of. And many of the players in the sector are too slow to actually get stuff sorted in a reasonable timescale.

“We are asking for people’s money. So we are selling them on a concept. And we haven’t been able to do that with housing co-operatives. We’ve been able to do it much more easily with people who the housing co-operatives ironically don’t like.

Related: Lessons from Europe’s housing co-ops

“We can prove the benefits of housing co-operatives to others – but, in a bit of a mad world, we can’t prove it to the housing co-operatives themselves.”

The Sheffield co-op is the first set up by Roost, which is now in the process of securing more leases for properties in London. The initial focus will be professionals living in London who want more control over the homes they live in, rather than those unable to make ends meet. These professionals will help Roost set up more housing co-ops.

The funding accumulated over the longer term will be used to acquire properties that will provide rented homes to a more diverse mix of people, including those in social housing.

“The nice thing about making our own money is that it comes with strings that we are more able to control,” says Dunn Flores. “And we can predict what future money’s going to come in. And a lot of co-operatives have got stuck in the trap of applying for one grant which funds them for a little bit, and then they need to apply for another grant and then another grant.

“They end up spending half their time applying for grants and the other half of their time trying to build a goal.”

Tenants at Roost’s Sheffield co-op include people doing different kinds of work – such as shift workers, post-graduates and professionals. “There’s a whole range of incomes,” says Dunn Flores. “We’re building something new and interesting, and there’s people who live there because of that. A lot of the tenants who were here before we moved on are international because this is one of the very few places in Sheffield that offers affordable rent for non-students. So we’ve got people in all different walks of life.”

Retail co-ops with housing stocks could also help, he argues. “A lot of them have substantial housing stocks. It’d be great if those housing stocks were run on the same sort of principles as their shops. A good landlord is much better than a bad landlord.”

According to a recent survey by TDS Foundation, two thirds of private renters have experienced a problem with the quality or condition of their property. The report also found that when tenants do not report issues, it is because they think reporting them would not lead to a solution or they are afraid of being perceived as “bad tenants” or having their rents increased.

One of the advantages of living in the co-op, apart from the city centre location and affordable rent, is having more freedom to make changes.

“We asked tenants not to help with the plumbing and the electrics, but apart from that, everything’s fair game,” says Dunn Flores. “For people’s individual rooms, they do whatever they want, for common areas and stuff that affects the whole building, each floor can make the decision.

“But we didn’t want to create a co-op where everyone is spending half of their lives in meetings. So we run most of it off WhatsApp, it’s pretty light touch.”

When it took over the lease of the building, the co-op inherited around 30 existing tenants, most of whom chose to become members.

One of the new tenants, who chose to stay anonymous, said he valued the “sense of ownership” – as well as being allowed to completely revamp his room, something he had never been able to do before as a tenant.

“We’re still in the early stages,” says another tenant. “People need time to get used to things and all that. And for some people, it’s just somewhere to live and they don’t want any trouble but they should realise that it’s good for them to be proactive.”

Roost wants to build up the co-operative ethos, says Dunn Flores – “in a building where people hadn’t necessarily heard of co-ops before. They weren’t used to the idea that they could, in one example, change their own curtain.”

Roost has bigger ambitions – and wants to be part of a wider process of change. Dunn Flores says the co-op wants to help set up housing co-ops around the world, to attract one million tenant members. “It is going to be really hard, but it’s something that we’re in a good position to be able to do,” he adds.

Asked what advice he has for other groups looking to set up housing co-ops, he says they need to be prepared to do “unsexy things”.

“Know who can help you in your local area,” he says. “Learn how to do the spreadsheets that relate to your property so that you don’t run out of money and be really careful with the contracts.

“And be willing to do a lot of unsexy stuff up to and including knowing exactly how you’re going to evict someone if that becomes necessary.”

Click here more of our special edition on housing and the co-op and mutual movements