High-performing leadership and regulation were two of the topics discussed at Centre for Community Finance Europe (CFCFE) conference on 24 September.

Held both in person in Manchester and virtually, the conference brought together credit union practitioners and researchers from the UK, Ireland and the USA.

Independent communicator Lucy Harr was one of the keynote speakers. A credit union practitioner, writer and public relations professional, Ms Harr has dedicated most of her career to work in the credit union movement and has held a number of senior executive positions at Credit Union National Association, a trade body for US credit unions, in addition to serving as secretary and as vice chair of Heartland Credit Union.

Joining the event virtually, she took part in a discussion on leadership moderated by Ciara Davies, CEO of Metro Moneywise Credit Union. Asked what makes a good credit union leader, she said the required qualities included being authentic, understanding one’s strengths and weakness, being self-aware, having empathy and having the right social skills to be able to work in a team.

As to what would make a great board, Ms Harr said that it was crucial for all board members to understand what their credit union aims to accomplish and focus on anticipating members’ needs, while working with the chief executive to achieve these goals.

“Teamwork is critical to make sure that everyone starts out on the same page and moves forward to put together the Google Map directions for where you want to go forward,” she added.

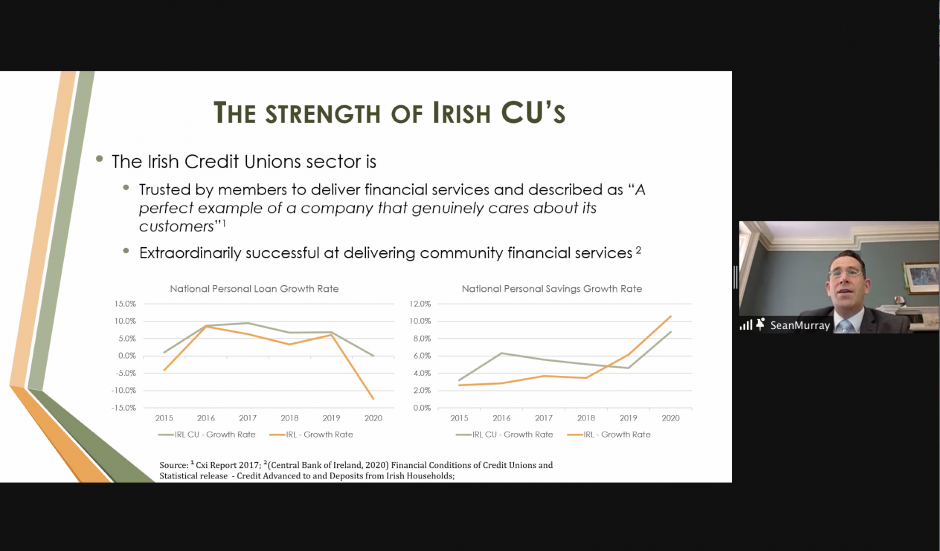

During another session Séan Murray, CEO of Comhar Linn INTO Credit Union in Ireland, explained why he wants reform of regulatory capital requirements for credit unions.

Mr Murray discussed the findings of a new paper by the Credit Union CEO Forum, which argues that these requirements are “excessive and unjustified relative to the risk profile of the Irish credit union balance sheet, international credit union requirements and the requirements on competing financial institutions”.

He explained that Irish credit unions are wholly reliant on retained surpluses to accumulate capital and added that they do no have access to capital markets or alternative sources of capital.

Related: Capital requirements are too strict for Irish credit unions, says study

“The current business model presents many other challenges – what do we find is that the current capital regime could be a blunt instrument rather than a risk-sensitive mechanism to protect members. As the CEO forum, we can bring these conversations forward with stakeholders in a shared environment,” he said.

Furthermore, argued Mr Murray, the balance sheet of credit unions is not considered complex, with funding coming from members’ savings and retained earnings and a cautious member attitude towards borrowing, “with a very marked preference towards saving and reducing debt”.

The paper found that credit unions in other countries are required to hold a capital ratio of between 3% and 6% of capital to assets, despite having much higher loan to asset ratios than Irish credit unions. Furthermore, the research identified a significant excess of capital in Irish credit unions as measured under other International capital regimes and Basel III requirements. The paper concluded that the 10% capital ratio “is not calibrated to balance sheet risk profiles, nor was it in line with regulatory requirements elsewhere”.

“There’s all too much talk about banking culture in Ireland, and yet – with the financial crisis, and several international studies that have shown the value in the ethos of credit unions – our pursuit of social and economic development rather than shareholder value creates this unique point of difference and competitive advantage from a capital perspective.

“That is also an extremely important quality because it generally suggests a lower risk and better alignment between the shareholders and the depositors, the people who capital is meant to protect.”

The paper’s proposed solution is to apply the capital ratio only to qualifying assets.

“In advocating for capital reform, the CEO forum argues for credit unions to be allowed to leverage the significant changes made by the sector over the last 10 years, and to provide the services on a level playing field. Current capital requirements are effectively making the sector commercially and practically unsustainable,” said Mr Murray.

The conference also paid tribute to CFCFE’s chair, Ralph Swoboda, who died on 13 September. CFCFE’s director of research, Dr Paul A. Jones, announced that the centre would change its name to the Ralph Swoboda Research Centre to celebrate his legacy.