The baby boomer generation is reaching retirement age – and with a huge number of business owners in their ranks, there is an opportunity for the employee-ownership sector to win new converts.

In the UK, the question of what happens when these firms transfer ownership has already caught the attention of the co-op and employee ownership sectors. Encouraging the switch to worker control has been highlighted as a route towards doubling the size of the UK co-op sector, a target set by the Co-operative Party.

In an independent report commissioned by the Party, the New Economics Foundation said: “There are around 120,000 family-run small and medium enterprises in the UK expected to undergo a transfer of ownership in the next three years. If just 5% of these businesses were supported to make the transition to employee ownership or one of the other mutual or co‑operative models available in the UK, then the number of entities in the sector would double.”

So how can the movement engage with businesses to encourage this process?

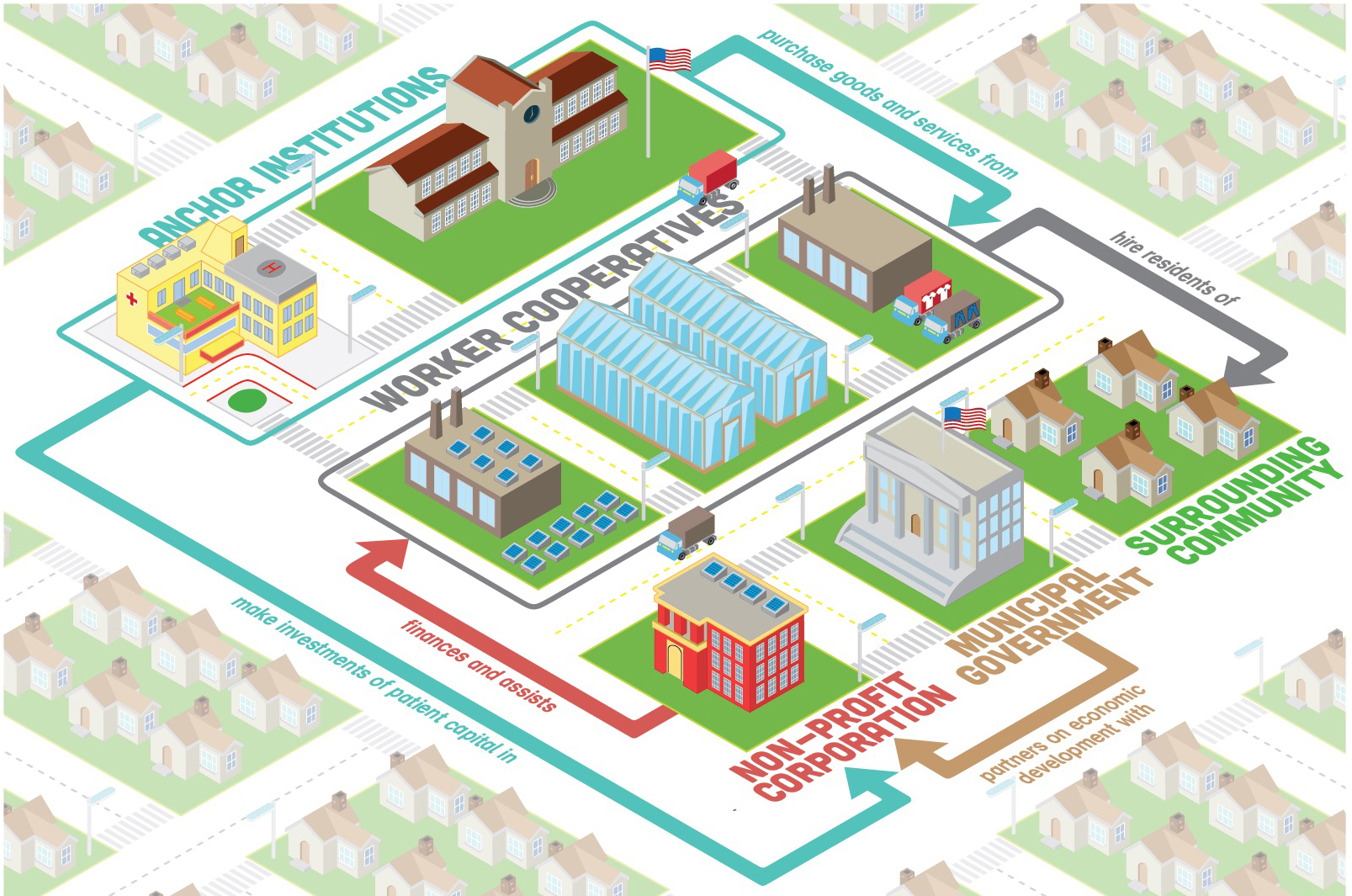

In the USA, Evergreen Co-operatives, with strategic advice from Democracy Collaborative, has launched an initiative to drive a new wave of business transitions. A network of co-ops, Evergreen is a key player in the Cleveland model which uses co-op ideas to build local democratic economies, which helped inspire the co-op councils movement in Britain. Democracy Collaborative is a nonprofit working on building community wealth.

Evergreen’s new project, the Fund for Employee Ownership, will purchase businesses in its home state, Ohio, for conversion to worker-ownership.

The team says the scheme offers a better alternative to the current situation, where businesses are often bought out by private equity firms, who then cut jobs or move them overseas or out of state.

The fund is also looking at industries that employ the workers Evergreen and Democracy Collaborative want to target – those on low incomes or facing barriers to employment.

Related: Co-ops and engagement: Lessons from Outlandish

Evergreen’s executive vice president Brett Jones, who is director of the fund, says: “We are just getting started but we are really optimistic about our ability to acquire firms in Cleveland that would be a great fit to convert to employee-owned. And we’re also optimistic about our ability to support those businesses to succeed and grow.

“Key to our success will be identifying partners who can help us connect with local business owners”.

Part of this engagement process is making business owners a positive offer. Jessica Rose, director of employee ownership programs at Democracy Collaborative, told business website Fast Company: “What we need to do is leverage mission-driven capital that can offer business owners an experience that’s as frictionless as any other exit option they have available to them.”

But can this model be used to spread the worker-ownership message elsewhere? Brad Jones says the fund is trying to demonstrate “a new way for impact capital to be put to use. The next few years will be focused on executing our strategy so one day perhaps the model can be replicated.”

Ed Mayo, secretary general of Co-operatives UK, says: “Here is a programme that is embedded in local networks in the city and state. Could we see cities in the UK operate in as proactive a way? If the fund can prove that it pays for itself over time, the wider benefits in terms of the local economy can be considerable.”

Deb Oxley, chief executive of the Employee Ownership Association, called the fund “a very exciting route to support regional economic resilience”, adding: “As the UK looks for new ways to protect jobs and stimulate regional productivity, while at the same time socialising capital, we need policy makers and politicians to be more ambitious and brave. In this regards, the UK could learn important lessons from the USA.”

Others are more cautious. Cath Muller from Co-operative Business Consultants suggested economic democracy would be better improved if the fund promoted worker co-ops, and pointed to a report for New York community development group The Pinkerton Foundation by Steven Dawson, which warned against “over-promise” by social enterprise investments.

“After six years and promises of creating 5,000 jobs, the three Evergreen Co-operative Enterprises in inner-city Cleveland today employ in total fewer than 150 workers – despite investing more than $17m in construction costs alone” wrote Dawson in February 2017; he pointed to similar problems in projects run by other cities.

Ms Muller added: “That said, of course there’s room here to take this proactive approach … Anyone providing large funds to further any level of worker agency is a great thing, even if I think there are more ambitious things that could be done with that amount of money.”