Meeting the needs of the modern consumer while addressing ageing memberships remain two key challenges for credit unions in Britain.

According to recent research by BNY Mellon in collaboration with the University of Oxford, millennials want to interact with financial providers through a range of channels, with websites and emails being the most popular choice (40%) followed by face-to-face contact (23%) and telephone (18%). How can credit unions position themselves as leaders?

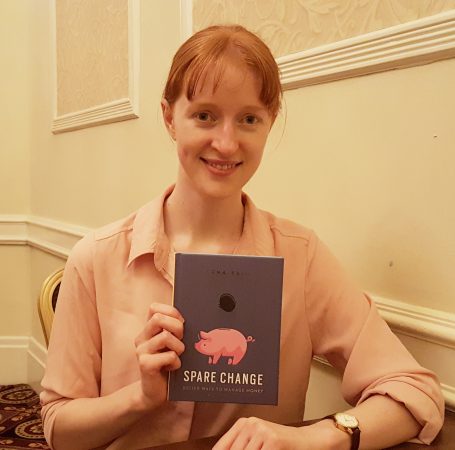

Personal finance journalist Iona Bain is founder of the Young Money Blog, dedicated to young people’s finances. Speaking at the annual conference of the Association of British Credit Unions (ABCUL), she described how the sector could engage with millennials.

https://www.youtube.com/watch?v=hRAlXoH7zjY&feature=youtu.be

“Credit unions could act as an alternative to financial advisers – they are good value and give advice about credit rating,” she said. “What’s missing is information about what is a bank and what is a credit union. Talk to them about their financial needs. Be there for them.”

Millennials – born in the 1980s and 1990s – were among the worst hit by the 2008 financial crisis.

“Their number one goal is getting on the housing ladder,” said Ms Bain – while other young people are struggling to pay bad debt accumulated via credit cards.

A 2016 survey by YouGov revealed that a third of young people aged 18-24 had debts of almost £3,000 and experienced “significant concerns” about money. Ms Bain’s book, Spare Change, looks at how people could save more, regardless of their background or income.

“Credit unions are already doing a fantastic job and they probably don’t get enough credit for being one of the financial institutions willing to tackle these challenges and engage the young people,” she said.

“They need to get out there more and explicitly market these products to young people and say ‘this is your safety net’. They have to embrace technology but not just do it as a box ticking exercise.

“Young people are naturally idealistic, are more willing to engage with a social community-led enterprise but the problem is if credit unions are not on their radar then they just don’t know about them.”

Ms Bain said credit unions should engage with young people by starting campaigns focused on one key issue rather than on the products they are offering and the technology available.

Another speaker at the conference, Emanuel Andjelic, looked at how credit unions could stay relevant in today’s fintech landscape.

Mr Andjelic is co-funder of Squirrel, a fintech which has designed an app to help people create and stick to a budget.

Squirrel works with businesses that want to offer the service as a benefit to employees, as well as local authorities and housing associations that may have issues with rent collection.

“We save and collect money at the source,” said Mr Andjelic, who does not perceive tech companies as competition for credit unions. “Tech companies want to build cool technology that works. As credit unions you are good at saving and lending. We could work together.”

Related: US credit unions take up voice interaction tech

He gave examples of micro-saving tools emerging in the financial market, such as Plum, the first artificial intelligence powered Facebook chatbot, which enables people to start saving small amounts of money. The tool connects people’s current account to its artificial intelligence to learn their spending habits, so it can automatically deposit small amounts of money into the Plum savings account every few days.

Similarly, Digit, a mobile app, connects users’ accounts to its platform to analyse their income and spending and find money it can set aside for them.

“You can imagine situations where you, as credit unions, owned these products,” said Mr Andjelic.

Squirrel charges a subscription fee of £3.99 per month, which can be paid by the user, the employer or the representative organisation. The app does not pay or charge any interest.

“Banks have online banking but no interest in helping you avoid debt,” added Mr Andjelic.

Asked about cybersecurity concerns, he said that Squirrel met high-level security standards and was regulated by the Financial Conduct Authority. This year Squirrel will launch a new feature to lock down savings by enabling users to nominate a person to authorise withdrawals.

“Don’t try to do tech yourself,” he said. “Partnerships are key to this so open up to collaboration. The fintech landscape is very collaborative, very open.”