Plans for new community banks are under way across the UK in an effort to transform the banking sector and provide more financial support to small organisations.

One of the key actors behind these initiatives is the Community Savings Bank Association (CSBA), which will act as a network for the new banks.

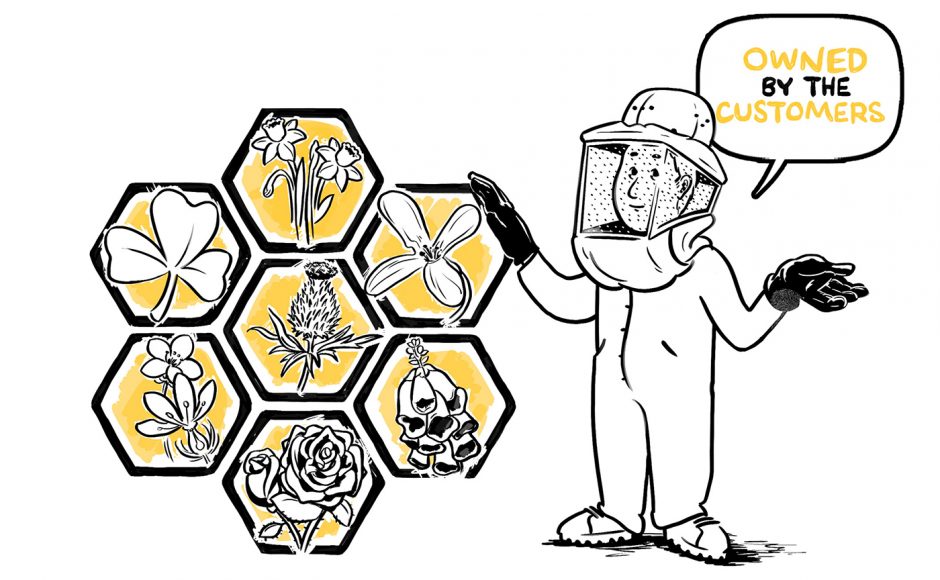

There are currently 11 banks in the network, at various stages of development. One of these is Banc Cambria in Wales, which wouldå be owned and run by members on a one-member, on-vote basis.

With traditional banks closing branches across Wales, rural communities and small businesses are unable to access short-term loans. A recent research by consumer experts Which? found that some parts of Wales have lost 80% of their banks since 2015.

Vulnerable communities are among the most affected. Another report by the National Assembly’s Economy, Infrastructure and Skills Committee called for intervention, arguing that bank closures are likely to impact certain marginalised and financially disadvantaged groups disproportionally. More than 200 banks have shut in Wales since 2008.

The Welsh government is supporting the partnership between Banc Cambria and the CSBA. Setting up a community bank for the country was one of first minister Mark Drakeford’s commitments in his 2018 manifesto.

Banc Cumbria is busy with the first phase of work, which includes a detailed project plan, stakeholder engagement, initial market assessment and feasibility study with the assistance of the Development Bank of Wales and Cardiff University.

A second, more comprehensive piece of market research will include market and consumer testing, says Ken Skates AM, minister for economy and transport.

Mark Hooper, project lead at Banc Cumbria, has been involved in the co-operative sector for 10 years, running Indycube, a community benefit society providing co-working space for freelancers.He says the project is currently at the pre-planning stage. “We want to go back to the communities that other banks have left,” he says.

Banc Cambria has received initial funding from the Welsh government, which is keen to ensure that credit unions are also consulted during

the process.

Mr Hooper says the bank will aim to compete with the big financial providers not credit unions.

How is Banc Cumbria going to be different from other banks? In addition to being member owned, the bank will also aim to promote a different approach to the provision of financial services.

“We won’t be offering credit cards, because credit card debt has a negative impact on society,” says Mr Hooper.

Likewise, Banc Cambria will not offer mortgages for second homes due to the effect they have on first-time buyers.

The bank will operate a different remuneration policy from the bigger players, says Mr Hooper, paying staff fairly without promoting huge benefits.

“This may not be the normal way for the UK, but in other countries this normal way of banking,” said Mr Hooper.

Once the bank is running, its main challenge will be to encourage people to switch accounts. “People are more likely to divorce than to change their bank account,” warns Mr Hooper.

But he thinks community banking is needed now more than ever in Wales; and to ensure its relevance, it will have a digital offer as well as a branch presence.

Starting from scratch also gives the bank the opportunity to use the latest available technology, says Mr Hooper, who is confident the bank will have an IT infrastructure as solid if not more solid than other banks.

“There is a real need for community banking today. People feel that big banks have forgotten about them – we have an opportunity to get into that market. The fact that it will take so long is a shame. But it’s a chance to do banking quite differently. Most people have little choice but to use one of those banks and they are all similar, it will be good to have choice. The time is now.”

Banc Cambria expects to be able to progress its application for Authorisation with the PRA and FCA during summer 2020. It anticipates a launch date between mid 2021 and early 2022, provided it is granted a banking license.

In England, three regional community banks being supported by the CSBA are at more advanced stage of development.

Related: Plymouth City Council backs new member-owned bank

The new mutual banks that could emerge by 2021 include South West Mutual, which would serve Cornwall, Devon, Dorset and Somerset; Greater London Mutual for the capital’s residents and Avon Mutual, for communities in Gloucestershire, Bristol, BANES and Wiltshire.

Local authorities in the North West of England, including Preston and Wirral, are also looking to jointly set up a community bank.

- Is community banking a useful way forward? What other options are there for co-operative local economies? Let us know what you think – email [email protected] or join the conversation on our Twitter and Facebook pages.