Training and education is one of the core co-operative principles. For credit unions, financial education is a cornerstone of their mission to build financial resilience in their members and the communities they serve.

Across the world, there are examples of credit unions leading innovative financial education initiatives to enhance people’s understanding, capabilities and confidence when it comes to finances.

In the UK, the community-based Just Credit Union works with schools to promote financial education across Shrewsbury. Sessions include money management, enterprise and awareness of predatory lending practices.

Through its Grow a Pound initiative, Just gives students the opportunity to use their skills and talents to generate money for the school, through activities such as bake sales, cleaning cars, origami and second-hand book selling. During the most recent Grow a Pound challenge, pupils at Wilfred Owen Primary school turned an initial £200 into £1,200 through their efforts.

The school was also visited by Sid the Shark, a mascot promoting awareness of predatory lending, in partnership with the Illegal Money Lending Team’s Stop Loan Sharks campaign.

As well as encouraging the next generation to better understand money, this kind of work also offers an opportunity for the credit union to promote its services do to parents and guardians and share how they can support people.

Just also offers a range of resources for adults to understand their finances better, such as benefits calculators and money saving tips.

Steve Barras, development officer at Just, says financial education is “core to do what we do.”

Related: Credit unions tackle community development challenge at Abcul conference

“It’s what we’re about. Our purpose is not to lend money, our purpose is to give people control of their finances.”

This is something that has become a priority for more people in recent years, with the pandemic and cost of living crisis prompting a need for many to put a sharper focus on their finances, says Barras.

“More people are now more aware of the need to manage their money,” he adds, “and therefore are more open than they perhaps were two or three years ago. We talk about maximising your income, so we have a benefits calculator on our website so people can go in and see what benefits they would qualify for, and then how to apply for those benefits.

“We also talk about taking a proper look at your bank statements and your credit card statements and what is on there … it seems like through the pandemic, people took out an awful lot of product subscriptions. If you encourage them, people will go back and figure out which ones they no longer need, and also shop around for the best deals.”

In the United States, Henrico Federal Credit Union (FCU) is also collaborating with educational institutions to spread their message and support communities.

In partnership with Henrico County Public Schools (HCPS), Henrico FCU opened the Financial Empowerment Center in the local Regency Square Mall. The centre opened its doors last year, offering workshops on subjects such as banking budgets and understanding probate. The centre celebrated its grand opening in February this year, and now offers full-time personal finance classes, with the support of the HCPS Adult Education Center.

Related: US National Coop Bank lends $3m to Henrico Federal Credit Union

Charity Rupp, financial education and marketing manager at Henrico FCU, said: “The more you understand the ins and outs of how finances work, the more empowered you are to make healthy choices in your journey. Before my own time at the credit union, I made a lot of mistakes that classes like these would have helped me to avoid. We are happy to pay it forward to the community with this new financial education facility.”

Moving south, Brazil’s credit union system Sicredi is inspiring the movement with its wide-ranging financial education work, from youth engagement to media campaigns and training programmes.

Educational programmes such as its Cooperação na Ponta do Lápis are delivered via Sicredi’s network of more than 100 credit unions, where participants are taken through a course based on behavioural science and economic psychology.

Sicredi’s financial education lead, Cristiane Nogueira do Amaral, says: “We believe it is not enough to give tools for people to change their financial lives, but it’s actually required for people to change their behaviour regarding their financial life. In order to provoke these behavioural changes, the programme has an understanding about a person’s emotions, desires and needs and the contexts that influence them in decision making.”

In schools, Sicredi delivers programmes such as the Jornada da Educação Financeira nas Escolas, which equips teachers with the knowledge they need to develop financial literacy among their students. Sicredi has also partnered with Brazilian cartoonist Mauricio de Sousa to produce a series of educational comic books set in the popular world of Turma da Mônica (Monica’s Gang). These books have been distributed to 8 million young people.

Overall, Sicredi’s financial education initiatives, including media work, have so far reached more than 21 million people, including its 7.5 million members, 40 thousand employees and members of the wider Brazilian population.

Thomas Belekevich, director of member services at the World Council of Credit Unions (Woccu), explains that it is not just the scale of Sicredi’s work that is impressive, but the message it has been able to communicate.

“The combination that Sicredi has been able to achieve, bringing together a focus on financial education with co-operative education, is a really powerful mix,” he says. “It opens people up to some great insights on how they can apply that, not just in their personal lives, but taken outward into their professional lives, as entrepreneurs, as business owners, and in so many aspects of life.”

Belekevich’s work involves facilitating knowledge sharing and exchanges between the world’s different credit unions, drawing particular inspiration from Latin America.

“Credit unions here in Latin America have made a really powerful and effective link between co-operative education and financial education,” he says.

“In the United States they do amazing work with financial education. There’s a whole slew of resources that the credit union system in the US has put together, tons of resources openly available for the financial education piece through credit unions.

“But what I think is missing from that sometimes is that co-operative piece, and I

think that it’s really the combination of those two that is really the most powerful. I think we’re missing part of the story if we don’t include both of those in that same process. Because that’s what makes us special.”

In response to a changing technological landscape, Sicredi is building its online presence alongside its existing work. This month, Sicredi launches a new online platform in conjunction with Brazil’s national financial education week, which will cover four key areas: simplifying money; financial growth and balance; behaviours influencing purchasing decisions; and demystifying the world of investing.

Meanwhile, back in the UK, Commsave Credit Union has launched a new online portal, CURight to help members and employees of its partner payroll companies manage their money effectively. The site features resources on topics such as saving, borrowing, and dealing with debt, and gives members access to a money motivation test, to help them better understand their relationship with money.

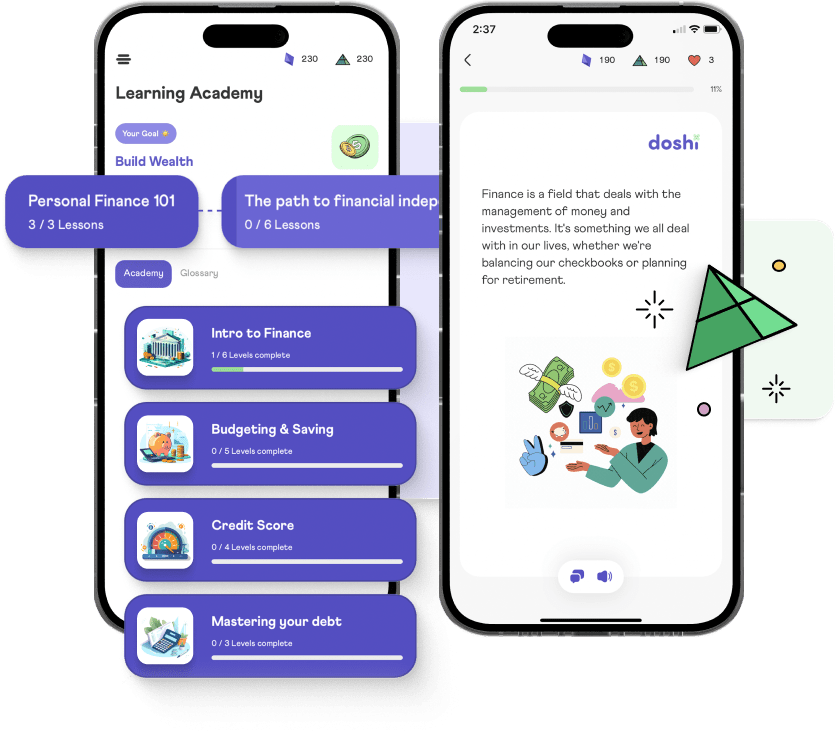

Members can also access Doshi, a financial education app where users can earn rewards as they move through the content.

“I’m a member of two credit unions in the United States, and I’ve never set foot in either of them”, says Belekevich.

“I joined online, and 100% of my experience with them has not been through a branch. How are we going to connect with people in a way that’s relevant and impactful, and shows our difference, if we’re increasingly moving away from this in-person contact that we historically have through our branch networks?”

For Belekevich, it’s about balance.

“A lot of my work at Woccu is connecting people face to face and engagement through experiences. There’s so much more that happens through that experience that we can’t lose track of in our strategy for financial inclusion, and co-operative education. I think it has to be both.”

Regardless of the changes credit unions are now facing, the mission guiding this work remains clear, and knowledge sharing between credit unions will be key to its success, says Belekevich.

“One of the defining factors that differentiates us from banks in particular is that we have people’s interests at heart.

“It’s very easy for credit unions to collaborate in this space because everybody benefits. That space for collaboration and education is just ideal, and it’s something that, because of our co-operative values, I think we’re in a position to leverage in a way that can be very helpful for the growth of the sector”.