Worker-owned retailer John Lewis has joined other high street names to back a new credit union to help store workers avoid payday lenders.

The new venture, retailCURe, works in association the retailTRUST, a charity formed to help involved workers and ex-workers in retail and related industries in the UK.

It aims to build a co-operative business that will be the preferred financial services provider for employees of UK retail businesses.

Joining John Lewis in backing the new credit union are high street names such as Debenhams, Iceland, New Look and Pets at Home, while former Dragons’ Den star Theo Paphitis has said that he and his companies have invested a six-figure sum in the not-for-profit enterprise.

Membership of retailCURe is open to any of the 4.5million people aged 16 or over who work in retail or a support industry – a sector which has a large number of workers on low pay.

The problem was highlighted in 2014 when retailTRUST identified mounting concerns among retailers about the number of employees reporting financial difficulties.

RetailCURE was devised in response, and in September 2016 the credit union received final authorisations from the Prudential Regulatory Authority and the Financial Conduct Authority.

It is now fully active in offering savings and loans to its members via its website and mobile apps. A growing number of retail employers are offering retailCURe services to employees through their payroll systems, and the organisation says its membership is steadily growing.

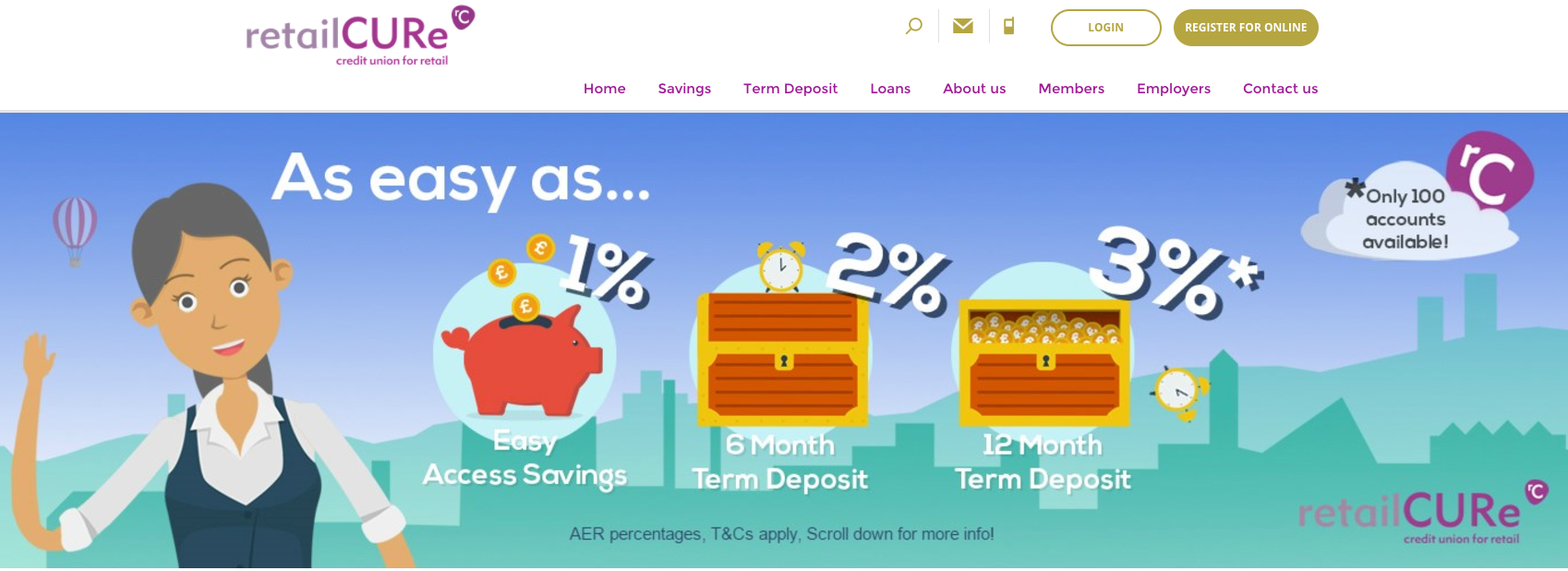

Members have access to loans from £500 up to £5,000 at interest rates ranging from 9.9% APR-26.8% APR. By contrast, many payday lenders charge more than 1,000% APR. It is also offering rates up to 3% on its savings accounts.

To join, an individual must open an easy access account with a £1 minimum deposit and continue to save regularly.