To mark Armed Forces Day on 30 June, London Mutual Credit Union launched a dedicated new financial support service for military personnel.

London Mutual Credit Union started providing loans to armed forces personnel in 2015, along with the PlaneSaver Credit Union and the Police Credit Union. The initiative is promoted under a joint platform, Joining Forces.

In 2015, research by the British Legion showed that 20,000 younger members of the ex-service community had taken out a payday loan in the previous twelve months. It concluded that by having access to financial services through credit unions, armed forces personnel and their families could avoid exposure to more costly alternatives.

Since partnering with the Ministry of Defence, London Mutual Credit Union has provided £2 million worth of loans to over 1,000 military personnel, saving them an estimated £1.3 million compared to the cost of high street lenders and various payday lenders.

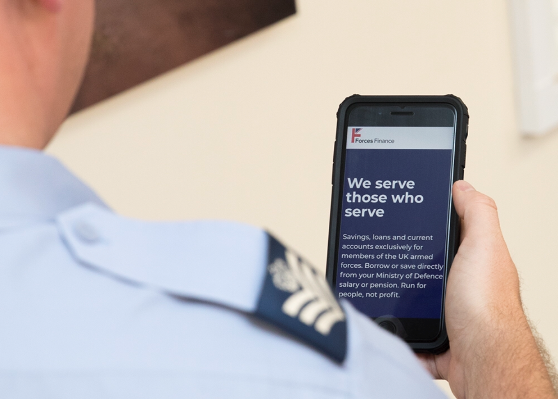

With the launch of the new Forces Finance initiative, the credit union will work with its members to design new financial products and member benefits tailored to meet the unique requirements of people in the armed forces.

Currently, the credit union has over 28,000 member-owners, who live or work in the London boroughs of Southwark, Lambeth, Westminster or Camden.

Lucky Chandrasekera, chief executive of London Mutual Credit Union, says: “Our figures show the clear demand for financial services built around the specific needs of armed forces personnel and their families. The disruptive and often highly mobile nature of life in the services can make financial planning difficult for many service personnel, as well as making it harder to build an address history or a strong credit record.

“The launch of the Forces Finance service is designed to build on our experience of working with armed services personnel over the past three years and underscores our commitment to delivering a bank built around ‘serving those who serve’.”

In addition to new services, the London Mutual Credit Union is also launching by a new website and marketing campaign to reach serving members of the armed forces.