MPs met in Westminster Hall this week to debate the contribution of co-operatives and mutual societies to the UK, and calling on treasury minister John Glen for measures to support the sector.

Conservative MP Steve Baker (Wycombe), who brought the debate at the request of sector body Co-operatives UK, said: “A free society – one based on a market economy – really must have within it a place for co-operatives, and the Conservative party might not always have embraced that idea as tightly as I might have liked.

“Given how long we will have been in power by the next general election, I hope that the Conservative party can champion and not merely embrace co-operatives as a really important part of a free society.”

He added: “Germany’s co-operative economy is four times bigger than the UK’s, and France’s is six times larger … Now is a moment when we can choose positively to take a path that makes it more possible for co-operatives in the UK to grow.”

Co-operatives UK suggests three lines of policy to boost the sector, he told the debate: tailored business support and finance for co-ops; a more enabling corporate framework; and tax support for investment in co-ops.

Sir Mark Hendrick (Lab/Co-op, Preston) said co-ops and mutuals “contribute significantly to social integration, job creation, employment sustainability and the reduction of poverty.

“If we are serious about levelling up the country and building back better, working people must be at the heart of economic recovery. Co-operatives and mutual societies provide a template for achieving success, where the principles of human and social capital are at the core of policy.”

Related: Co-operative economy report paints a resilient picture

Stephen Doughty (Lab/Co-op, Cardiff South and Penarth) highlighted the example of Big Fresh Catering Company, a local authority company in Vale of Glamorgan built on co-operative principles. “In its first year, it has turned a £350,000 deficit into a £500,000 surplus, which is now being reinvested in our schools. That is an example of co-operative principles making a difference, led by Welsh Labour and Co-operative councillors.”

Christina Rees (Lab/Co-op, Neath) is one of a number of politicians in the UK and Welsh parliaments who have called for a UK version of Italy’s Marcora law, which establishes funds and gives workers the right to buy their companies.

In Italy, the measure has seen investments of more than €300m in 560 companies, saving the jobs of 25,000 workers and retaining the skills and experience of the Italian workforce, she said. “Hundreds of Italian businesses at risk of closure have been preserved as worker co-operatives, with a return of more than six times the capital invested,” she added. “Our UK Co-operative Party public polling shows that 64% believe that the economy would benefit if workers could buy their businesses when they were at risk of closure.”

She paid tribute to the work of the Wales Co-operative Centre, which has warned of a “business succession time bomb” in the family business and SME sector. “One in five SMEs faces the prospect of closure or succession in the next five years … 15,000 business owners may be leaving their businesses. That is one of the reasons a UK Marcora law is so important: to save family businesses.”

To that end, she said Huw Irranca-Davies, MS for Ogmore and chair of the Senedd co-operative group, introduced an employee ownership bill to the Welsh Parliament to help workers buy out their workplace if it is at risk of failure. On 11 January, Ms Rees will introduce a similar ten-minute rule bill in the UK Parliament.

Jim Shannon (DUP, Strangford), highlighted the work of credit unions and housing co-ops in Northern Ireland. He said community-led housing and self-build initiatives could deliver affordable housing and called on the government to work with devolved administrations to investigate ways that credit unions and mutuals can help to finance these.

Luke Pollard (Lab/Co-op, Plymouth, Sutton and Davenport) said co-ops can drive grassroots entrepreneurialism and prevent the “hollowing out of our communities”. He called on the government to adopt Labour’s policy of doubling the size of the co-operative sector. “It is a bold, challenging ambition,“ he added. “However, if ministers put in place the right conditions to make it happen, it is also achievable.”

He highlighted examples in his own city, such as Nudge Community Builders, which works to transform life chances in one of the city’s poorest community by refurbishing buildings, to create spaces for start-ups, social enterprises and community services. “It is helping to restore pride in something by allowing people to invest in their own community through that effort,” he said.

Mr Pollard praised the community share model because it is “about the social purpose – the social multiplier– and the economic multiplier that will come from that investment.”

He warned: “That innovation is often at the periphery, because co-operatives and mutuals are not mainstreamed in the way that they really need to be. There is not an accelerator that moves those ideas into the mainstream.” To remedy this, he said, “financial resourcing barriers need to be removed”, and he called for a co-operative development agency in England similar to that of Wales.

“We could put new duties on governments to promote the growth of co-operatives, not just of businesses. We could look at new capital instruments, such as a national co-operative-held investment bank, which would allow better investment in UK co-operatives. We could consider a new duty on banks to encourage greater lending to co-operatives and to ensure banks are held to account over the types of businesses they support.“

Ms Rees suggested shared ownership schemes, where co-ops own part of a public or private enterprise. Mr Pollard agreed, describing the concept as “co-operative insurgency … it is not only about creating a co-operative or mutual from day one; it can be about mutualising a business model. Even a small, co-operatively held component of a big publicly listed company could help drive and direct an ethos and culture change within that business, which could produce better outcomes.”

But Mr Pollard warned there were problems for the sector. “Our Plymouth credit union is on the verge of closure, which I worry will deny access to finance for people on the margins of finance and society in particular.

“The basic bank accounts that the Treasury has been promoting via businesses will not be enough to replace the service provided by Plymouth credit union, and I encourage the minister to look at what happens when credit unions fail.”

Chris Stephens (SNP, Glasgow South West) discussed the importance of co-ops in Scotland, particularly in terms of community energy and the drive for net zero.

And he called on the minister to “join me in pushing the Prudential Regulation Authority to consider changing the capital requirements for credit unions. Successful credit unions appear to be getting punished if their assets rise above £10m.”

He also praised the work of Scottish Enterprise, which works through Co-operative Development Scotland, to support the co-op model. It helps businesses and community enterprises grow by offering advice and services, including free masterclasses and one-to-one support.”

The Scottish government, he added, runs a flagship community and renewable energy scheme – CARES –to community across Scotland, and increase in the number of shared-ownership energy installations, and it beat its target of 500mW of community and locally owned energy by 2020. He said it was important to help rural and island communities become carbon neutral.

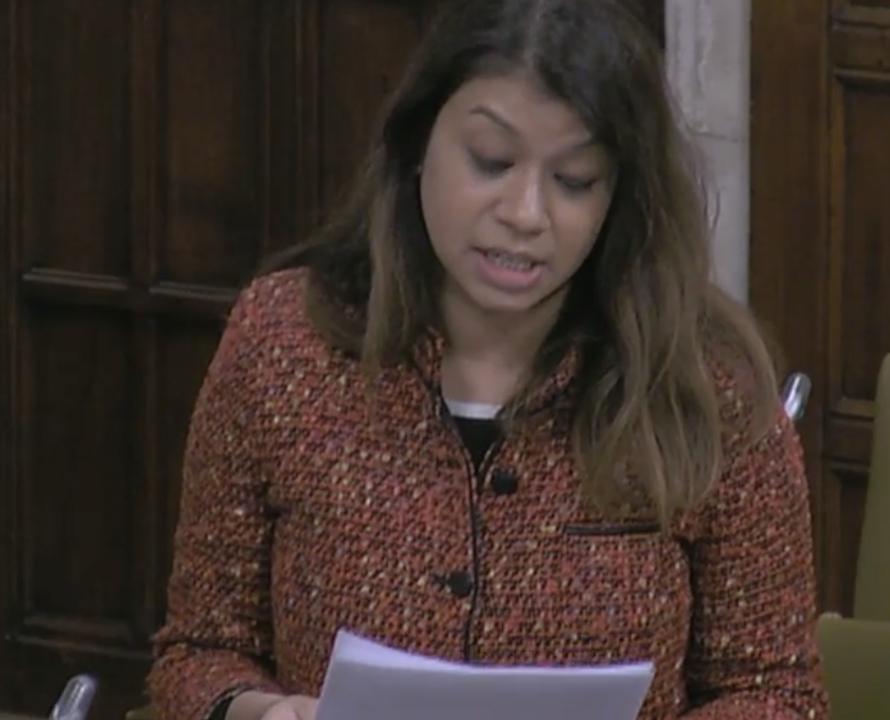

Tulip Siddiq (Lab, Hampstead and Kilburn), said: “Not everyone in the government has been a friend to the sector. Less than 1% of businesses in the UK are co-operatives … If the government were really serious about levelling up and building back better, they would be looking to learn from other countries about how to expand the sector. Instead, the growth of co-operatives in this country is being held back by a legislative and regulatory framework that is not designed for co-operative businesses.”

She thanked Mr Baker for securing the debate and for his past support for co-ops, but added: “I wish more Conservative members would support him and champion this cause.”

Mr Glen said he would “reflect carefully” on the debate and “examine further the proposals that underlay some of the contributions this morning, but I will also think about what we can do to work with regulators to address those drivers.”

Mr Glen said the government had taken steps to help the sector, including the Co-operative and Community Benefit Societies Act 2014 which reduced the burden of red tape, and had included the sector in its Covid-19 support packages, and in the Community Ownership Fund.

With reference to the Marora Law, he warned: “We need to recognise the difference between the UK and Italian economies, which I think will make the Marcora law less effective here. We cannot subsidise businesses that are predisposed to fail.”

He said he was open to further discussion, but said: “Italy has a much higher rate of long-term unemployment than the UK has currently, so it is not clear if providing an advance sum of unemployment benefit would generate savings on welfare spending in the UK, as it may do in Italy.”

With regard to mutuals and credit unions, he said they are “levelling up in action” by delivering financial stability. Prompted on the issue of regulation, he said that last year the PRA had implemented a simplified capital regime for credit unions to remove barriers to growth. “I hope I will be allowed to introduce legislation next year to address some outstanding concerns that exist within the sector as a whole,” he added.

Other government initiatives cited by Mr Glen include a £3.8m pilot for the no-interest loans scheme, run by Fair4All Finance, and a prize-linked savings scheme for credit unions trialled in March, in collaboration with sector body Abcul, to encourage saving and raise awareness of the model. “We have 13 credit unions around the country … and I hope more will join them in future.”

Last week, he added, the government had proposed changes to the Building Societies Act 1986, to give them greater flexibility in their funding model, maintain their mutual status, and update their corporate framework in line with companies.

Pressed by Sir Mark Hendrick on the threat of demutualisation to building societies, Mr Glen said: “We have genuinely put in place specific interventions across a number of dimensions of the broader sector to ensure that building societies can continue to operate more effectively, offering services that their customers want, and retain their current status.”

But he warned: “It is important that we strike the right balance between hearty aspirations for a healthy sector receiving appropriate consideration of reasonable changes to the rules and regulations underpinning them, and a doe-eyed romanticism about things that are not financially secure in the medium and long term. My job is to interrogate those opportunities and take legislative action where I can, but also to be clear that we have to take a clear, economically valid and reasonable approach to this issue if we are going to have a secure and thriving sector.”