The Co-operative Group has returned to the red for the first time since the crisis of 2013, in its annual results for the year ending January 2017.

It reported an operating profit of £148m (2015: £112m), driven by £20m profit on disposals, largely reflecting the sale of its crematoria, and lower restructuring costs.

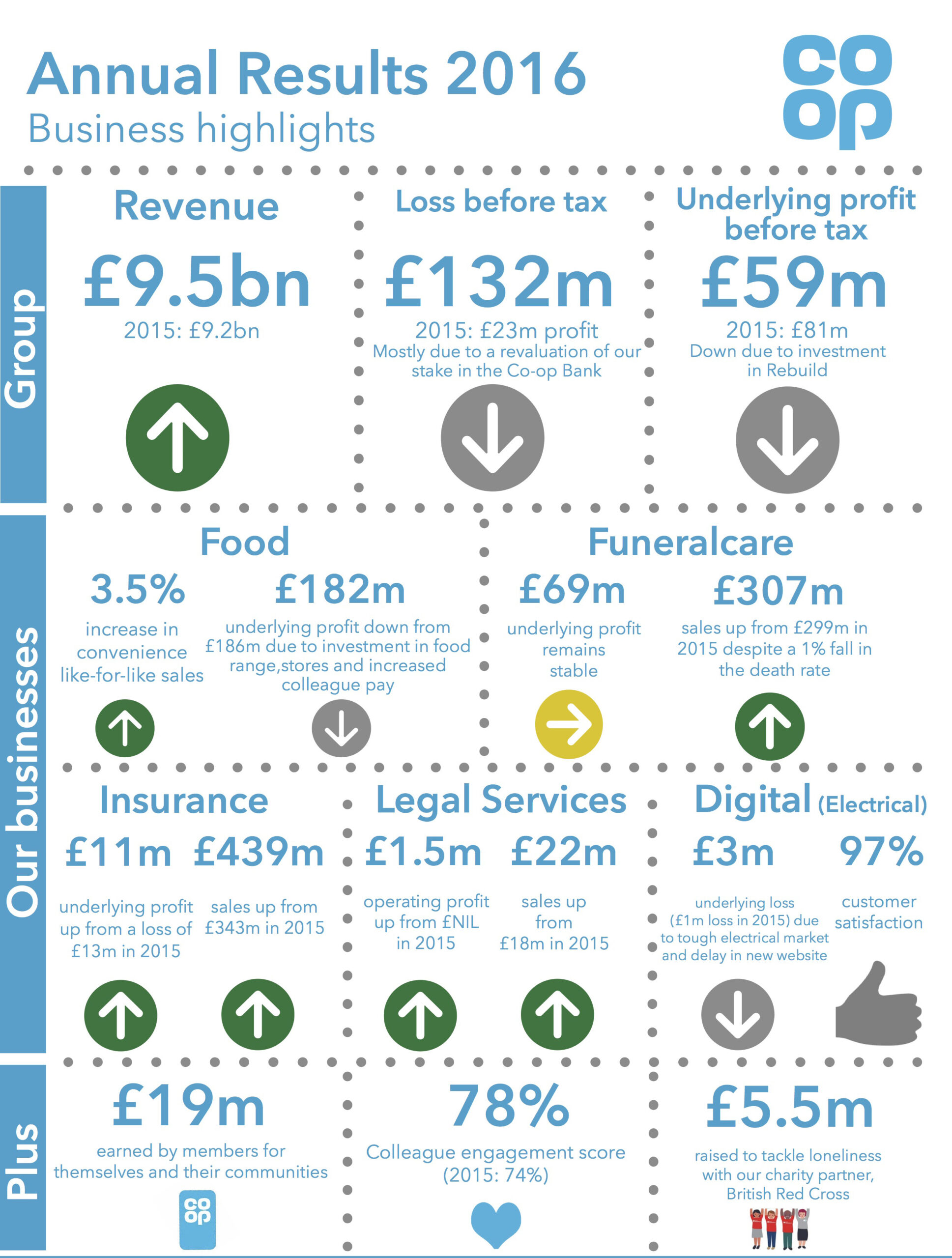

An underlying profit before tax of £59m (2015: £81m) was down, due to increased rebuild investment, according to the Group.

But the Group reported a loss before tax of £132m (2015: £23m profit), which reflected a £74m increase in finance costs due to changes in the value of its bonds, and a writedown in the carrying value of its 20% shareholding in the Co-operative Bank to zero – offset in part by one-off gains.

It said that, because of the volatility caused by the ongoing sales process at Bank, it had adopted a prudent valuation of its Bank shareholding at £Nil (2015: £185m).

The Group lost control of the Bank to hedge funds under a bailout deal after a £1.5bn hole was found in its finances, relating to the ill-fated Britannia merger, in 2013.

The Group – which is now considering the sale of its remaining stake – also had to shed its pharmacy and farms businesses before embarking on a three-stage turnaround plan – Rescue, Rebuild, Renewal.

Revenues increased by 3% to £9.5bn (2015: £9.2bn), while:

- Food like-for-like sales rose 3.5%, driven by core convenience business, as Food continued to outperform the market

- Funeralcare revenues grew by 3% and market share increases for first time in five years, driven by move to make funerals more affordable and 69% increase in sales of pre-paid funeral plans

- Insurance delivered strong sales, up 28%, based on motor premium inflation, improved pricing and distribution capabilities.

Since last year’s launch of the Co-op’s new identity, more than 600 Food stores and 200 Funeral homes have been rebranded. Following the launch of its 5 +1 membership scheme, it is expected to reach its target of recruiting 1 million new members by the end of 2017, a year earlier than planned.

Active membership hits 4 million at year end, with a further 350,000 members already recruited in 2017.

Progress to the original target of recruiting 1 million members by the end of 2018 has significantly accelerated and is now due to be reached by end 2017.

Chair Allan Leighton said: “This was an exceptional year for the Co-op and these results show the success of all the work to rebuild. We’ve invested in our brand, our businesses and our colleagues and now we can clearly see the benefits – a big jump in membership, better sales and increasing market share. The Co-op is now better for members, better for colleagues and better for communities up and down the UK.

“This investment was made in a disciplined fashion and within our agreed debt profile. All of this was achieved while staying true to our purpose, as evidenced by the millions we are paying out to local causes.”

Chief executive Steve Murrells said: “We’ve made great progress in rebuilding our Co-op, with all our businesses delivering strong performances. While much remains to be done, our Rebuild plans have really started to deliver value for our customers, our members and their communities. That is exactly what the Co-op should be doing.

“Against this backdrop, 2017 sees us turning our attention to the next phase of our development. Our ambition will remain the same – championing a better way of doing business in communities up and down the country. We will continue to take our existing businesses forward and ensure they are ready for the digital age, but we will also look wider than our current markets.

“We are exploring how we can enter markets that are not serving people well and challenging existing providers. To do that we are thinking again like the original Rochdale Pioneers. They were true pioneers in every sense of the word – disruptors in markets and agitators for change. There’s never been a more exciting time in the Co-op’s history and we are confident that we’ll continue to thrive.”

Mr Murrells added that the co-op difference has never been more “relevant or timely””.

“As a co-op, we exist to create value for our members by running a successful business that stays true to our ethics and our commitment to commercial responsibility. In the coming years we have the opportunity to show why the UK needs a strong Co-op. With trust in big business in sharp decline and community life under increasing pressure, our purpose to ‘champion a better way of doing business for you and your communities’ has never been more relevant or timely.

“Our job is to prove that relevance and show our Co-op difference in all we do – through the say we give to our members as co-owners of the business; the products and services we offer; our strengthening of local communities; and our national campaigns. We have a unique story to tell and we must tell it well.”

In the annual report, he added: “We should adopt the attitude and actions of the original Rochdale Pioneers, most of whom were still in their twenties and thirties when they started the modern co-op movement 170 years ago. Just as they did, we must disrupt and surprise the market for the benefit of our members. We’ve starting looking at potential new markets where a co-op solution could become a game-changer just as it did in the 19th and 20th centuries.

“I’m convinced this is the time when we can really lift our heads again, show how our Co-op is a business you can really trust, and that ethical responsibility and commercial success can go hand in hand. We know we have fantastic business potential and there’s a hunger out there for something different. Our job is to meet that craving with a Co-op response and anticipate where it will go next.”

Nick Crofts, president of the members council, said: “The co-op model is often thought of as complex – but at its heart it’s simple. Businesses that are owned by members, run to meet their needs and to deliver benefit to them rather than shareholders.

“Members elected to our Council play a key role in our Co-op. The Council and its members have unparalleled access to our Co-op’s business leaders and opportunities to work alongside and collaborate with colleagues to develop new business ideas. Our Rules codify the role and formal relationship of the Council with the Board and business – but it’s the working relationships, trusted constructive challenge, dialogue and passion for being a co-operative business that is shaping how our governance contributes to our co-op difference.

“Allan Leighton and I have developed a particularly positive working relationship and it has been extremely helpful in delivering on the Council’s agenda.”

A summary of results:

Co-op Food

Sales Total sales up 1% at £7.1bn; like-for-like sales up 3.5%

Operating Profit Up 4% to £203m (2015: £196m)

Underlying Operating Profit Down 2% to £182m (2015: £186m)

View from the Group: “We continued to deliver against our strategy to make better food available to people in the places they want to shop, as we aim to be the UK’s leading convenience food retailer. More people are coming to our stores and they’re shopping more often. Our total sales were £7.1bn in 2016 (up from £7.0bn in 2015) while like-for-like sales rose by 3.5%. We enjoyed being the fastest growing food retailer excluding the discount supermarkets on a like-for-like basis. We invested in refitting stores, increasing colleague pay, improving our infrastructure and strengthening our food range, especially local British produce. Even after making such an exceptional investment for our future competitiveness and prosperity, underlying operating profit was only slightly down on last year at £182m (£186m in 2015).”

Co-op Funeralcare

- Sales Total sales up 3% to £307m

- Operating Profit Up 43% to £99m (2015: £69m)

- Underlying Operating Profit Flat at £69m

View from the Group: “Revenues in our Funeralcare business rose 3% to £307m (2015: £299m) in spite of a small decline in the death rate and our moves to cut prices. We grew market share for the first time in five years, with share of the ‘at need’ market up 1.9% to 16.4%, and our ‘pre-need’ market share increasing to 28%. Plan sales rose 69% and customer satisfaction hit a record high of 95.2. Underlying operating profit was in line with last year at £69m (2015: £69m) as we continued to invest in the estate. Operating profit was £30m higher at £99m, boosted by the profit on the £41m sale of our crematoria. As a result, the Co-op increased its market share by 47% in the pre-need funeral market. We invested heavily in 2016 to give people a better service and expand into more communities. Our 1,000th funeral home was opened in the year, and over three years we plan to open 200 more to serve more of our members in more communities. As well as opening 41 new homes, we refitted 200 existing ones as part of our plan to refit the entire estate by the end of 2019. We also continued to invest in our technology and operations, freeing colleagues to spend more time with the bereaved.”

Co-op Insurance

- Sales Total sales up 28% to £439m, with Gross Premiums up 15%

- Operating Loss £18m, down from a loss in 2015 of £60m

- Underlying Operating Profit £11m, up from a loss in 2015 of £13m

View from the Group: “Revenues in our Insurance business were 28% higher at £439m (2015: £343m), as we wrote more motor policies against an inflationary backdrop for premiums due to claims inflation, together with a favourable movement in the value of claims from previous years. At the same time we continued to improve our pricing and distribution capabilities. This translated into an increase in underlying operating profit to £11m, up from a loss of £13m in 2015. The 2016 outcome includes a cost of £15m to reflect the change in the rate, set by the Government, which we use to calculate some of our longer term claims. The absence of any significant weather events like those that struck northern England and Scotland in 2015 saw lower claims than in previous years. Underlying operating profit excludes the one-off costs associated with our transformation programme, on which we continue to progress. Including these one-off costs we made an operating loss of £18m, in line with our plans, compared to a £60m loss in 2015.”

The outlook, according to the Group:

- All of our markets remain fiercely competitive and we face a challenging consumer and economic backdrop. Given our unique ownership structure, we will continue to invest in all our businesses and in member benefits, focused on the long term.

- In Food, food price inflation will be a factor in 2017, but we remain confident that our compelling member offer will continue to drive sales. In Funerals, we expect to continue to improve our member offer through the creation of our Life Planning division, which will combine our Funeralcare and Legal Services offer in one business. In Insurance, market conditions remain fiercely competitive and the outlook for premiums remains uncertain due to inflationary pressure from sterling weakness.

- Against this backdrop, and in line with our long-term plans, we’ll continue to invest to make our Co-op attractive to members and customers.

- As indicated last year, we made no dividend payments to members in 2016 and we have been clear that this will continue through our Rebuild phase, with a continued focus on the 5+ 1 member benefit.

- The benefits we offer to members are fundamental to our strategy. The initial response to the new member benefits was ahead of our expectations, both in terms of new member numbers and increased card usage by existing members. Against that backdrop, by the end of 2017 we expect to have 1m new members, taking membership to almost 5 million. With this target we would expect payouts to members and local causes in 2017 to be over £70m collectively.