Ukrainian credit unions upgraded their websites with support from the Credit for Agriculture Producers (CAP) Project funded by the United States Agency for International Development (Usaid) and implemented by World Council for Credit Unions (Woccu).

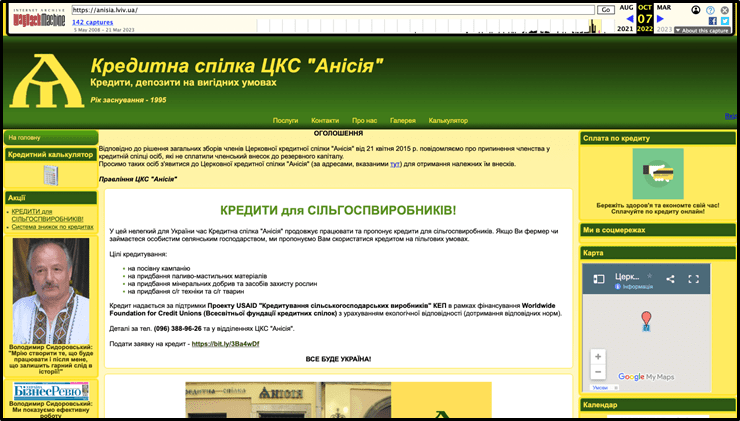

The new websites are designed to incorporate modern trends while meeting the new regulatory standards for consumer information disclosure as set by the National Bank of Ukraine.

The project helped the two credit union associations, two central credit unions and 49 individual credit unions in Ukraine upgrade their websites. Special features include a tailored calculator tool that allows a member to compute the fair price of loans and deposit products.

The platform also allows the credit unions to tailor their website content to their needs and aesthetic.

CAP was launched in 2016 as a four-year project to strengthen the Ukrainian credit union market. The project has since been extended twice, most recently through to 2024.

Areas of focus include supporting the development of new regulations, managing a USAID-funded US$1m liquidity fund to allow credit unions to meet the loan demands of member farmers, assisting credit unions to build their capacity and supporting credit union associations and central credit unions to better serve their member institutions.

Ukraine is home to 337 credit unions with 456,941 members and US $105m in assets.