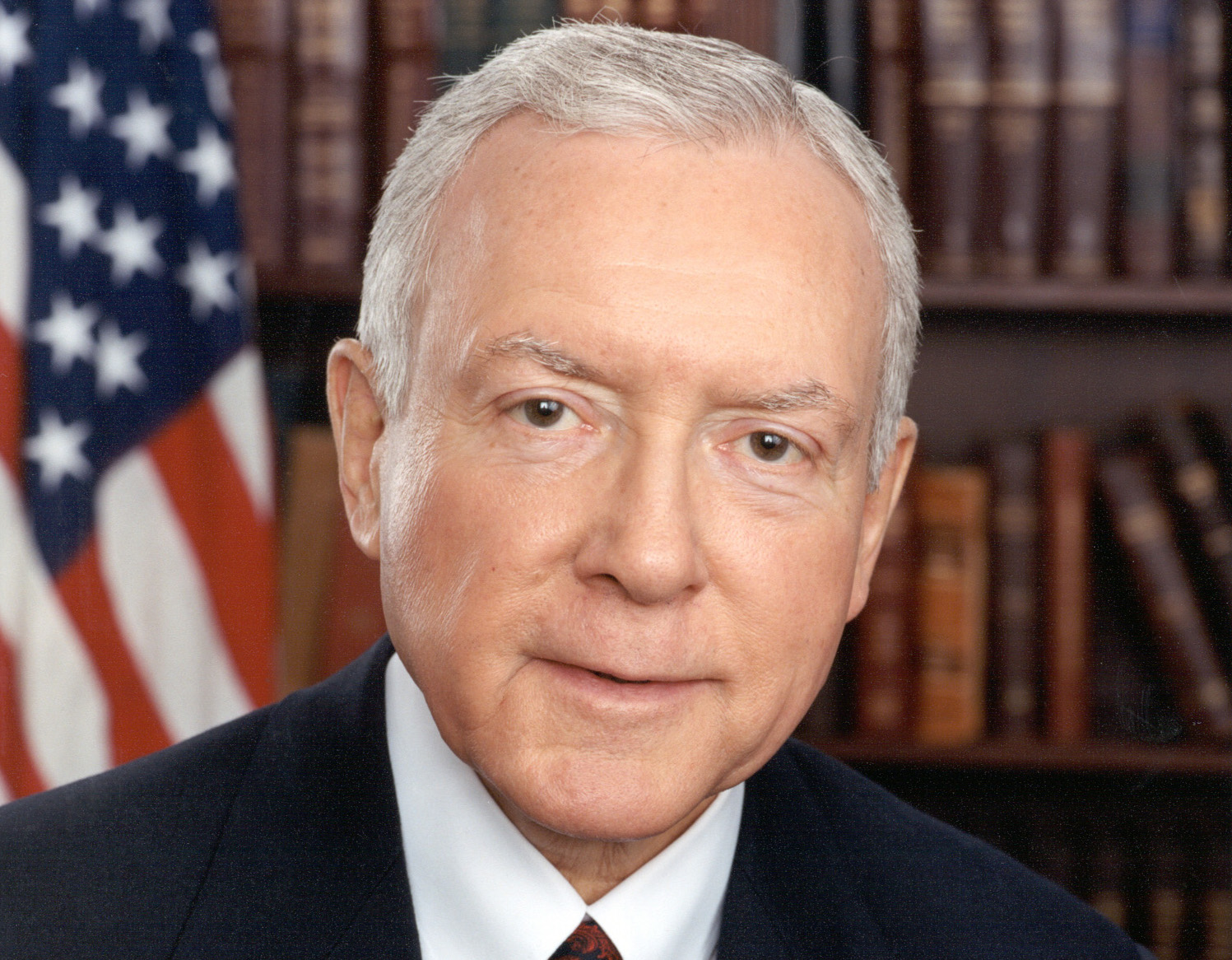

Credit unions in the USA are defending their right to federal tax exemption, following questions raised by Senate Finance Committee chair, Orrin Hatch.

Federal credit unions across the country are currently exempt from federal corporate income tax on the grounds that they operate on a not for profit basis, are organised without capital stock, and operate for mutual purposes.

However, state credit unions pay unrelated business income tax on income from activities not related to their tax-exempt purpose. The tax exemption is valued at USD2.9bn a year, according to the Joint Committee on Taxation.

On 31 January, Mr Hatch sent a letter to the National Credit Union Administration (NCUA), in which he expressed concerns that many credit unions are taken further from their original tax-exempt purpose. He added that recent actions taken by the National Credit Union Administration have relaxed the field of membership constraints and lifted limits on activities such as business lending, which, argued the Senator, has traditionally been less associated with the mission of tax-exempt credit unions. He claimed that other activities carried out by some credit unions are “beyond the scope of their original mission”, such as offering insurance products, real estate brokering and wealth management.

The letter also asked the NCUA to explain various aspects related to its role in overseeing credit unions.

Responding to Mr Hatch, National Association of Federally-Insured Credit Unions (NAFCU) executive vice president of Government Affairs and general counsel, Carrie Hunt, sent a letter that advocated for preserving the exemption.

“The credit union tax exemption has long provided tremendous value to credit union members and the overall economy of the United States,” wrote Ms Hunt. “An independent study of the benefits of the exemption found that it provides a $16bn per year benefit to the US economy. Removing the tax exemption would prove detrimental to the economy over the next 10 years through: $38bn in lost income tax revenue; $142 billion in reduced GDP; and the elimination of nearly 900,000 jobs.”

The letter makes the case for credit unions to continue to be supervised by an independent NCUA and clarified that the NCUA’s regulations are in accordance with the Federal Credit Unions Act.

NAFCU argues that without the tax exemption, credit unions could lose their identity and may need to adjust their savings and borrowings rates as well as their ability to raise capital and attract volunteers.

Another response to the senator’s letter came from Jim Nussle, president and chief executive of the Credit Union National Association (CUNA), a trade body.

Writing to Mr Hatch, he said: “In the aftermath of the financial crisis, more Americans are choosing credit unions as their best financial partner. In fact, more than 12 million Americans have joined credit unions since 2008. Some may have joined because their bank failed, moved or was acquired by another institution; and others may have joined because they grew frustrated with the policies and fees of the for-profit sector.

“What is important is that when they needed an alternative, a healthy credit union system with the capacity to grow was ready to serve them, and as credit union members, they benefit from conducting their financial services with an institution that they own. The credit union tax status is crucial to encourage and support the continued existence of this alternative, co-operative component of the financial system and we thank the Committee for preserving the existing credit union federal income tax status.”

However, Senator Hatch’s letter was welcomed by the Independent Community Bankers of America (ICBA), which represents smaller banks.

“Large, multi-bond and geographic-based credit unions have exceeded their statutory mission and use their tax-exempt, government-subsidised status to gain competitive advantage over taxpaying community banks,” said ICBA president, Camden Fine, in a statement.

“Senator Hatch’s comments echo the ICBA’s belief that the credit union model has become outdated and that its charter, purpose and tax-exempt status should be reviewed by Congress.”