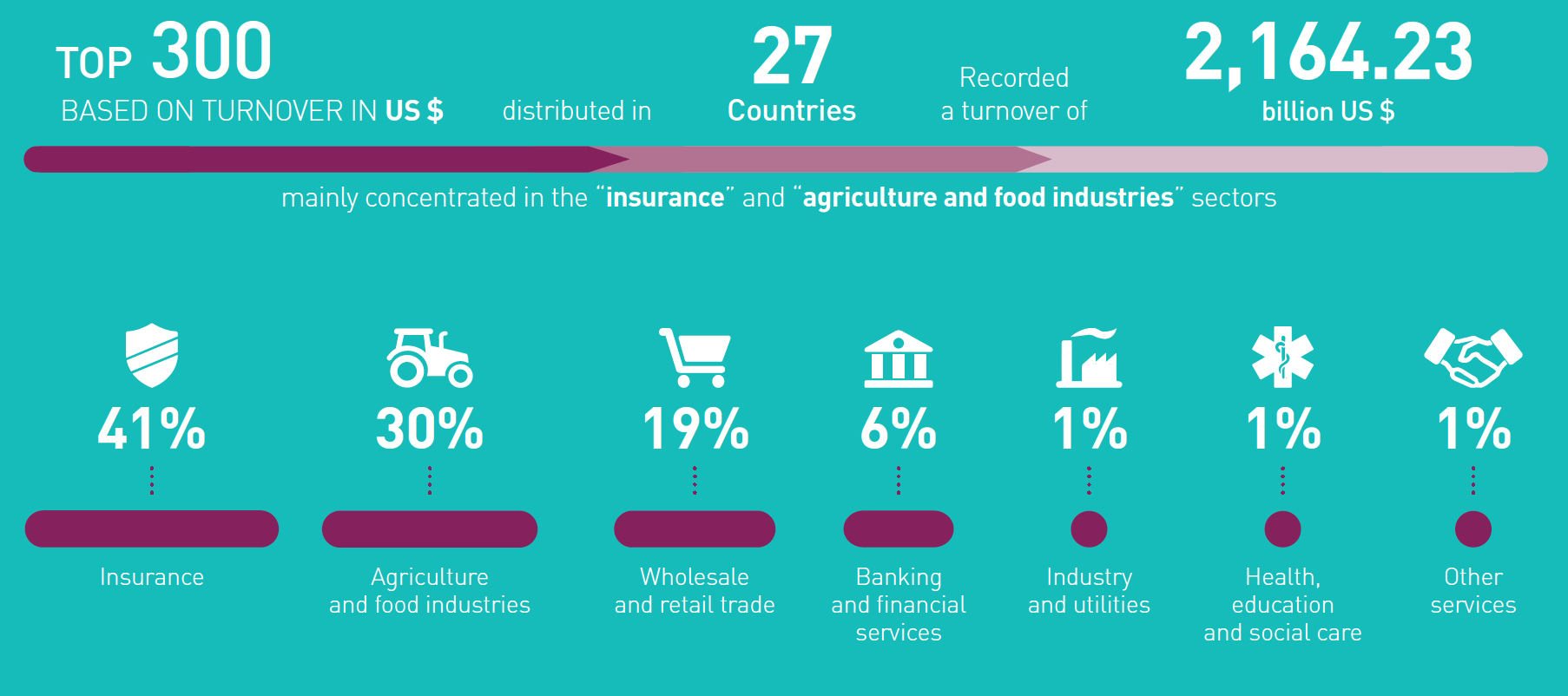

The largest 300 co-operatives and mutuals in the world have a combined turnover of $2.164tn.

The figure is revealed in the latest World Co-operative Monitor, which was presented at the International Co-operative Alliance’s Global Conference and General Assembly in Kuala Lumpur, Malaysia.

The Monitor collected data for 2,379 organisations across eight sectors of activity, 1,436 of which had a turnover of more than $100m. Now in its sixth year, the Monitor is produced in partnership with the International Co-operative Alliance and the European Research Institute on Cooperative and Social Enterprises (Euricse).

Presenting the results of the study, Gianluca Salvatori, chief executive of Euricse, said automation meant the skills needed in the workforce were those “based on human interaction and empathy, that cannot be replaced by machines”.

“Building a sense of common good is becoming a priority in all our societies,” he added. “It means there is a new space for co-ops, creating a new trust in societies. This is our role. It should be a priority of the co-op system to show the contribution of the co-operative model to social progress.”

He said the world was also seeing a transition to a knowledge economy, with companies like Google and Apple seeing huge success because of their use of big data.

In a press conference after the presentation, Mr Salvatori said the co-op movement was sitting on “a mountain” of unused data.

“The co-op movement could collect an enormous amount of data about the needs of society and people,” he added. “We need a change of mindset in the co-op movement to collect that data and interpret it to plan new services.”

Mr Salvatori said the monitor showed that the top 300 co-ops were all well capitalised, but smaller and younger co-ops were in need of support. Going forward, he suggested more mechanisms of mutual support within the movement, with funds and loan guarantees for new co-ops.

He gave the example of Italy’s co-op development fund, paid for by a mandatory 3% levy on co-op profits, and said such ideas should be studied to see how they could be replicated elsewhere.

Charles Gould, director general of the Alliance, added: “We are attempting to get data on smaller co-ops. We’re pushing for more national-level monitors. If the countries could produce their own reports on their own movements, we could look deeper into those.”

Asked about problems affecting larger co-ops in recent years, such as the Co-op Group and Murray Goulburn, he said it would be interesting to investigate the relationship between capital and governance when there was more information.

The Monitor refers to data from 2015, which was collected from various sources such as national rankings, sector rankings, existing databases containing financial data and annual reports.

According to the Monitor, in 2014 the top five co-operatives based on turnover were:

- Groupe Crédit Agricole, France – $70.89bn

- Kaiser Permanente, USA – $67.44bn

- State Farm, USA – $64.82bn

- BVR, Germany – $56.26bn

- Zenkyoren, Japan – $49.17bn

Insurance is the largest sector represented within the top 300, which takes up 41% of entries. Other sectors include agriculture (30%), wholesale and retail trade (19%), banking and financial services (6%), industry and utilities (1%), health, education and social care (1%) and other services (1%).

To ensure consistency, this year’s ranking is created by converting the home currency into the international dollar, using World Bank calculations. One international dollar would buy in the cited country a comparable amount of goods and services a US dollar would purchase in the United States. This method was used to provide a better picture of the purchasing power parity of the co-operative. The new methodology was used to create a ranking based on a value that removes the conversion distortion.

Also new this year is a trend analysis on the top co-operatives and mutuals by sector activity. The monitor also features a trend analysis on the top co-operatives and mutuals by sector activity, as follows:

Agriculture and Food Industries

Data was collected for 668 agricultural organisations from 35 countries, 454 of which had a turnover of more than $100m. The top 20 of these came from 11 countries and had a combined turnover of $273.02bn. The biggest co-operative is Zen-Noh from Japan, followed by CHS from the USA and NH Nonghyup in the Republic of Korea. When calculated in International Dollars, the ranking changes with NH Nonghyup coming second and CHS third.

Industry and utilities

There were 111 organisations from 12 countries in this sector, of which 74 had a turnover higher than $100m. The largest co-operative was Mondragon Co-operative from Spain ($13.35bn turnover), with Basin Electric Power Cooperative in the USA coming second ($2.13bn) and Oglethorpe Power Corporation from USA ($1.35bn) on the third position. The top three ranking does not change when the turnover is calculated in international dollars.

Wholesale and Retail Trade

The report collected data for 289 organisations from 32 countries, 215 of which had a turnover of over $100m. At the top of the list is REWE Group in Germany ($48.18bn), followed by ACDLEC – E. Leclerc in France ($39.25bn) and Edeka Zentrale from Germany ($31.82bn). The top three ranking remains unchanged when done based on international dollars.

Insurance

Across 41 countries, statistics were gathered for 549 organisations, of those 484 had a turnover of over $100m. Ranked first is Kaiser Permanente in the USA with a turnover of $67.44bn. It is followed by State Farm also in the USA ($64.82bn) and Zenkyoren in Japan ($49.17bn). The top three remain the same when based on international dollars.

Banking and financial services

The top 10 co-ops and mutuals came from seven different countries and had a collective turnover of $194bn. The top three are Groupe Crédit Agricole from France with a $49bn turnover, BVR from Germany ($44.81bn) and Groupe Credit Mutuel from France ($31.21bn). The top three remain unchanged when the ranking is done based on international dollars.

Health, Education and Social Care

The sector has a combined turnover of $28.5bn among the top 10, which come from six countries. They are Unimed from Brazil with a turnover of $15.92bn, Health Partners from the USA ($5.74bn) and Group Health Cooperative in the USA ($3.66bn). The top three ranking does not change when using international dollars. However, under the new methodology, a Colombian co-operative – Universidad cooperativa de Colombia enters the top 10.

Another addition to this year’s report is the analysis of the capital structure of not only the Top 300 but also a sample of smaller co-operatives and mutuals, allowing for comparison of different types of co-operative businesses. The results of the research on capital show that large co-operatives and mutuals do not have specific problems raising capital related to the co-operative business model, though smaller co-operatives do have some challenges mostly related to obtaining internal capital and long-term debt.

• To read the full results, visit: www.monitor.coop